Understanding Cryptocurrency: A Primer for Conservative Investors

After spending January exploring the fundamentals of financial planning – from estate planning to choosing your professional team, and diving deep into ETFs and mutual funds – we now face a topic we’ve been hesitant to address: cryptocurrency. As your guide to financial literacy, we believe it’s time to tackle this subject, not because we’re endorsing it, but because understanding crypto has become part of being an informed investor.

What Is Cryptocurrency, Really?

Before we dive into investment considerations, let’s break down what cryptocurrency actually is in simple terms. Think of cryptocurrency as digital money that exists on a technology called blockchain – essentially a sophisticated digital ledger that records all transactions. Unlike traditional currency issued by governments (like the U.S. dollar), cryptocurrency is decentralized, meaning no single authority controls it.

Bitcoin, which you’ve probably heard the most about, was the first cryptocurrency and remains the largest. But it’s just one of thousands of cryptocurrencies. Others include Ethereum (often used for digital contracts), and various “altcoins” (alternative cryptocurrencies) each with their own claimed purposes and features. Just as you wouldn’t assume all stocks are the same, it’s important to understand that not all cryptocurrencies serve the same purpose or carry the same risks.

You May Already Have Indirect Crypto Exposure

Here’s something many investors don’t realize: if you own broad market index funds or mutual funds, you likely already have some indirect exposure to cryptocurrency. Many public companies now have connections to the crypto economy:

- Tech companies like Microsoft and IBM developing blockchain technology

- Payment processors like Visa and PayPal handling crypto transactions

- Companies like MicroStrategy and Tesla holding Bitcoin on their balance sheets

- Financial firms like Goldman Sachs and Morgan Stanley offering crypto services

This indirect exposure through established companies can actually be a more measured way to participate in the crypto economy’s growth – you’re investing in businesses that are exploring crypto while maintaining their traditional revenue streams. Keep in mind though: when cryptocurrency prices surge or plunge, your indirect exposure through these companies won’t mirror those dramatic moves. These companies’ stock prices are influenced by many factors beyond their crypto involvement.

Why Address Crypto Now?

Major financial institutions including BlackRock, Fidelity, Charles Schwab, JPMorgan, Goldman Sachs, and Morgan Stanley are now recommending small cryptocurrency allocations in portfolios. This dramatic shift from traditional Wall Street firms raises important questions that deserve careful consideration. Instead of simply telling you whether crypto belongs in your portfolio, let’s use this as an opportunity to apply the critical thinking skills we’ve been developing.

A Tale of Two Investments

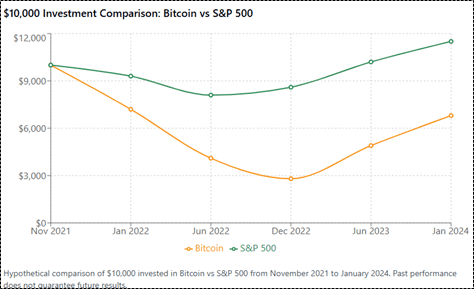

Let’s consider a hypothetical comparison. Imagine investing $10,000 in Bitcoin in November 2021, when crypto enthusiasm was at its peak and Bitcoin was trading around $69,000. Following a classic “buy and hold” strategy, you would have watched your investment drop dramatically through 2022 (falling below $16,000) before recovering somewhat. By early 2024, over two years later, you would still be sitting on significant losses.

Now, consider if you had instead invested that $10,000 in an S&P 500 index fund. Despite market volatility, including the challenges of 2022, you would have benefited from corporate earnings, dividends, and the overall growth of the U.S. economy. This comparison isn’t meant to predict future performance, but rather to illustrate an important point about the difference between speculative trading and long-term investing in productive assets.

Take a look at the chart below to see exactly what we mean – notice how differently these two investments behaved over the same time period. While the S&P 500 experienced its own ups and downs, the Bitcoin investment showed far more dramatic swings and ultimately lagged behind.

Understanding the Institutional Shift

When established Wall Street institutions recommend crypto exposure, it’s easy to feel pressure to follow suit. But let’s break down what’s really happening:

Why are institutions changing their stance?

- Client demand and competitive pressure

- The emergence of regulated products like ETFs

- Fear of missing potential opportunities

- Revenue from new crypto-related products

What they’re actually recommending:

- Very small allocations (typically 1-5% of portfolios)

- Careful risk management

- Professional oversight

- Regulated investment vehicles

Trading vs. Investing: A Critical Distinction

When you hear stories about people making fortunes in crypto, it’s important to understand what’s really happening. Most successful crypto gains come from active trading – buying low and selling high, often multiple times as the market swings up and down. This is very different from the buy-and-hold strategy that works well with traditional investments like stocks and bonds.

Let’s break this down:

Trading:

- Involves actively buying and selling based on market movements

- Requires constant market monitoring

- Demands technical analysis skills

- Often means taking profits during price spikes

- Needs deep understanding of market dynamics

- Carries significant risks and can lead to substantial losses

Buy-and-Hold Investing:

- Works well with assets that generate value over time (like stocks paying dividends)

- Relies on long-term economic growth

- Doesn’t require constant market attention

- Historically successful with broad market indices

- Generally lower stress and lower cost

When your friend tells you they “made a fortune in crypto,” ask whether they were trading or holding. Chances are, they were actively trading -timing market moves and taking profits along the way. While their success stories are exciting, remember that for every successful trader, there are many who lose money trying to time the market.

What This Means for Your Portfolio

If you decide to include crypto in your portfolio, understand that a buy-and-hold strategy might not yield the dramatic returns you hear about in crypto success stories. That’s okay – as long as you’re clear about what you’re doing:

- Keep allocations small (as most institutions recommend)

- Be prepared for long periods of losses or stagnation

- Understand you might miss out on gains in traditional investments

- Accept that your returns likely won’t match those of skilled traders

- Consider it as part of your overall diversification strategy, not a get-rich-quick opportunity

Remember: There’s nothing wrong with having a small crypto allocation, but understand what you’re getting into. If you’re not prepared to actively trade (which most long-term investors aren’t), your crypto investment might behave very differently from the success stories you hear about.

A Framework for Critical Analysis

When evaluating any investment recommendation, especially for newer assets like crypto, ask:

- Who benefits from this recommendation?

- Are there fees involved?

- What are the conflicts of interest?

- What’s the underlying value proposition?

- How does it generate returns?

- What drives its price?

- How does it fit your strategy?

- Does it align with your goals?

- Can you stomach the risks?

The Power of Saying “No”

Remember: You don’t have to invest in something just because it’s popular or because Wall Street institutions recommend it. Sometimes, the most empowered decision is choosing not to participate when something doesn’t align with your investment philosophy.

Looking Ahead

As the crypto market matures, we may see changes in how these assets behave and fit into portfolios. But for now, approach with caution and skepticism. Understanding crypto’s role (or lack thereof) in your portfolio is about more than just following trends – it’s about applying critical thinking to make informed decisions.

Key Takeaways

- Question recommendations, even from respected institutions

- Understand the difference between trading and investing

- Consider how any investment fits your personal strategy

- Don’t feel pressured to follow trends

- Apply critical thinking to all investment decisions

Remember: Your financial journey is personal. While it’s important to stay informed about developments like cryptocurrency, it’s equally important to maintain a disciplined approach aligned with your goals and values.

A Final Thought

This discussion about cryptocurrency isn’t just about whether to invest -it’s about developing the critical thinking skills needed to evaluate any investment opportunity. These skills will serve you well beyond the crypto question, helping you navigate whatever new investment trends emerge in the future.

Please note the original publication date of our articles. Some information may no longer be current.