TSP Financial Wellness: Insights from the 2023 Survey and Beyond

As we approach the midpoint between the Federal Retirement Thrift Investment Board’s biennial Financial Wellness Surveys, it’s an opportune time to reflect on the findings from the 2023 survey and consider how they might inform our financial planning strategies moving forward.

This biennial survey, combined with discussions from the January 2024 FRTIB meeting, paints a detailed picture of federal employees’ financial landscape and the TSP’s role in shaping their retirement futures.

Key Findings

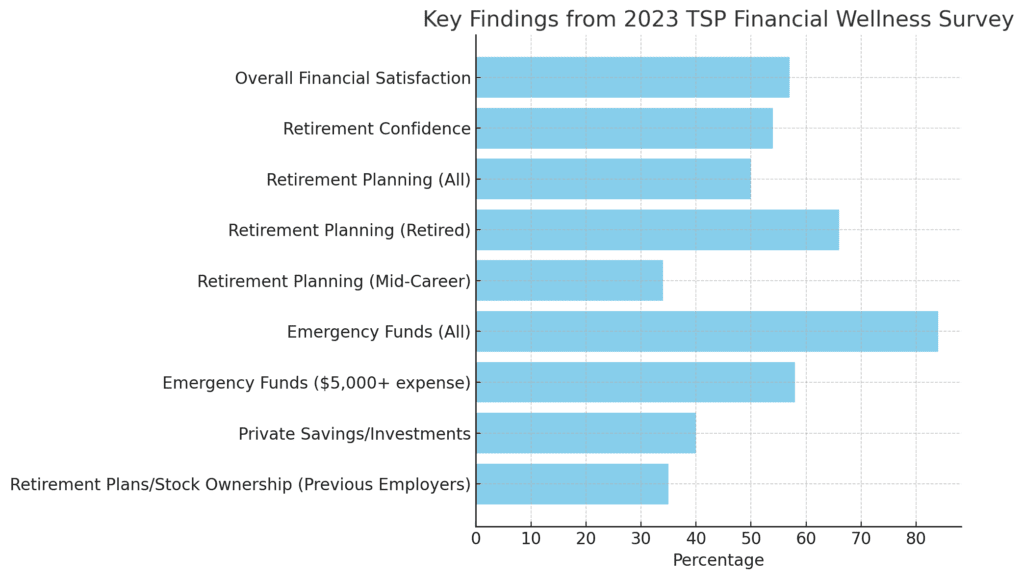

- Overall Financial Satisfaction: 57% of surveyed participants reported satisfaction with their overall financial condition, a slight increase from 55% in 2020. This compares favorably to a Gallup survey finding that only 45% of the general public would rate their financial condition as good or excellent.

- Retirement Confidence: 54% of participants are confident they’re on track for a comfortable retirement. However, this represents a slight decline from 2020, particularly among mid-career participants and those separated from government service but employed elsewhere.

- Retirement Planning: About half of participants have an estimate of how much they’ll need in retirement. This figure rises to two-thirds for retired participants but drops to just over one-third for mid-career participants.

- Additional Retirement Income Sources: 40% of participants report having private savings/investments, while 35% have retirement plans or stock ownership from previous employers.

- Emergency Preparedness: 84% of respondents have emergency funds set aside, with 58% able to handle an unexpected $5,000 expense. This compares favorably to a CNBC survey where only 45% of the general public reported having an emergency fund.

Barriers to Retirement Savings

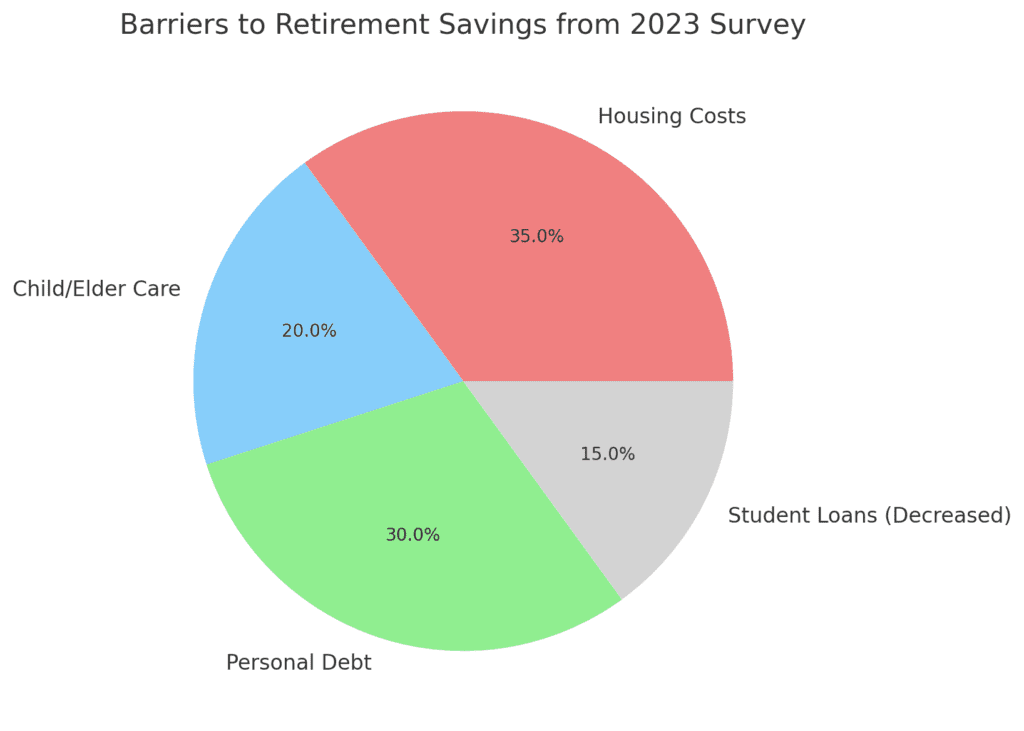

The survey identified several key barriers to retirement savings:

- Housing costs (rent/mortgage) remain the biggest obstacle.

- Child and elder care expenses have increased since 2020.

- Personal debt continues to be a significant factor.

- Interestingly, student loans decreased as a barrier, possibly due to the pause on repayments during the survey period.

Money Management Practices

The survey revealed a strong correlation between money management practices and retirement confidence:

- Participants who track their savings and investments are twice as likely to be confident about retirement.

- Those who have an estimate of their retirement needs are 2.7 times more likely to be confident.

- Common practices include tracking expenses, paying down debt, and budgeting.

TSP Offerings and Participant Feedback

Participants expressed interest in enhanced tools and resources:

- Withdrawal and savings tools were identified as potentially most useful.

- Webinars and podcasts also garnered significant interest.

- Notably, there was a significant drop in interest for cryptocurrency offerings compared to the 2020 survey.

Implications and Future Directions

During the January 2024 FRTIB meeting, board members and executives discussed the survey’s implications:

- Early Career Focus: There’s a recognized need to better engage and educate early-career participants about retirement planning.

- Action step: If you’re early in your career, consider attending TSP-sponsored webinars or reviewing the “New to the Federal Government” section on the TSP website.

- Uniformed Services: The Blended Retirement System (BRS) is seen as a positive step in improving retirement outcomes for service members, with automatic enrollment and matching contributions.

- Action step: Service members should review their BRS benefits and ensure they’re maximizing their TSP contributions to receive full matching.

- Communication Strategies: The Agency plans to use survey results to refine its communication and training approaches, particularly for early-career participants.

- Action step: Stay tuned for new educational materials from TSP. In the meantime, explore the TSP YouTube channel for informative videos on various retirement planning topics.

- Tool Development: The high interest in retirement planning tools may influence future TSP offerings and enhancements.

- Action step: Familiarize yourself with current TSP tools like the Contribution Comparison Calculator and the Retirement Income Calculator. For more advanced planning, consider third-party retirement calculators like those offered by Vanguard or Fidelity.

- Recordkeeper Innovations: Accenture Federal Services (AFS), the TSP’s recordkeeper, plans to use the survey data to brainstorm innovations, particularly to engage younger participants.

- Action step: Keep an eye out for new features in your TSP account interface. Regularly log in to ensure you’re aware of any new tools or resources as they become available.

Putting Insights into Practice

The 2023 Financial Wellness Survey provides valuable insights into the financial health of TSP participants. While there are positive indicators, such as high emergency fund rates and overall financial satisfaction, there’s still work to be done in areas like retirement planning education and addressing savings barriers.

As we look ahead to the next survey in 2025, it’s crucial for each of us to take an active role in our financial wellness. Here are some steps you can take today:

- Review your TSP contribution rate. Are you maximizing your agency’s match?

- Use the TSP Retirement Income Calculator to estimate your retirement needs.

- If you don’t have an emergency fund, start one today, even if it’s with a small amount.

- Implement at least one new money management practice, such as tracking your expenses or creating a budget.

- Set a reminder to review your retirement strategy quarterly. Regular check-ins can help you stay on track and make adjustments as needed.

Remember, financial wellness is a journey, not a destination. By staying informed, utilizing available resources, and taking proactive steps, you can work towards a more secure financial future. The TSP is here to support you along the way.

Please note the original publication date of our articles. Some information may no longer be current.