Your guide for retirement news, insights, and resources

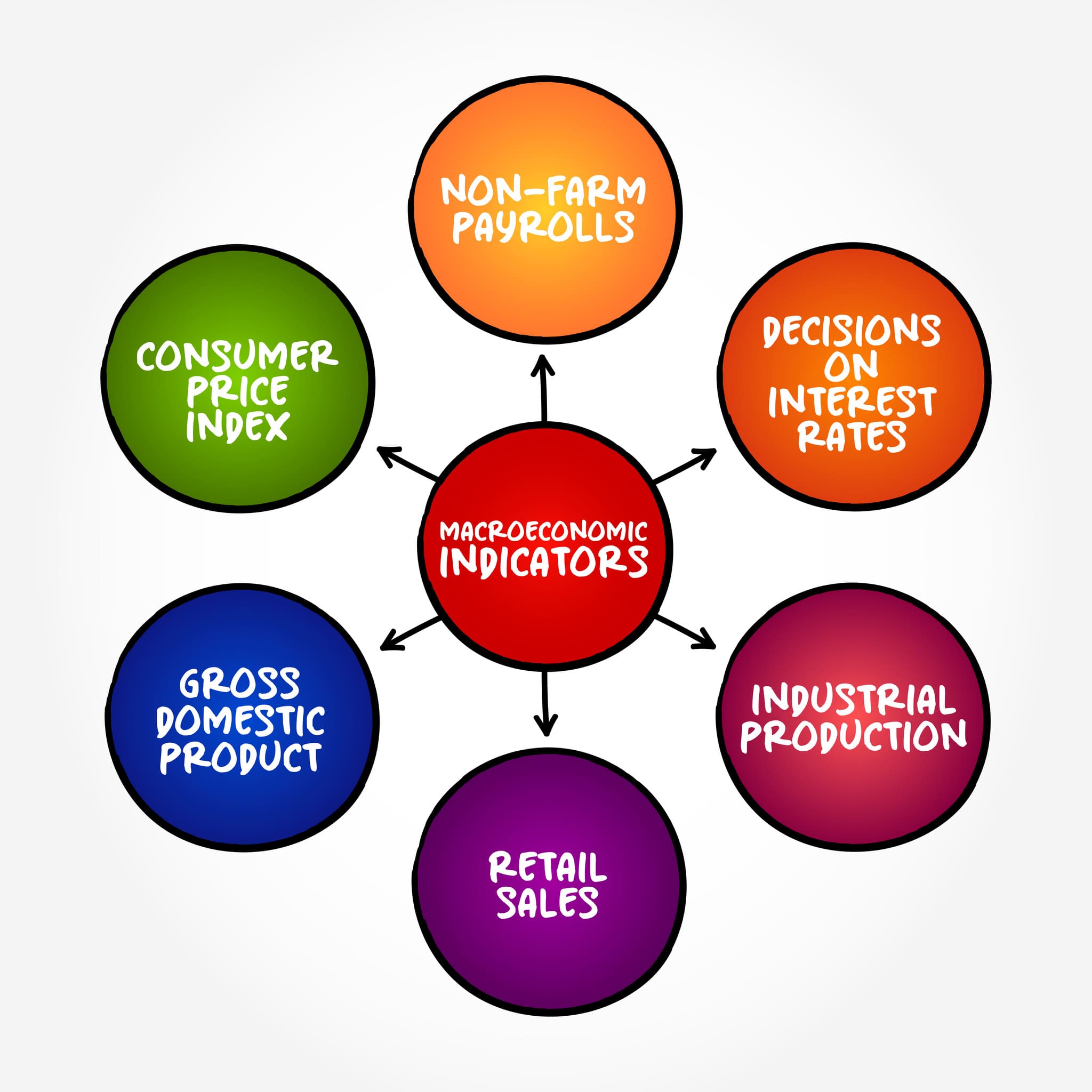

Why Does News Cause Market Swings?

Ever wonder why a company reports record profits and the stock drops? Or why bad economic news sometimes sends the market up? News affects markets – but not always in the way you’d expect. The Power of Earnings, Fed Announcements, and Data Drops Some news matters more than others. Corporate earnings reports give investors a…

Continue ReadingHow Can You Prepare for Volatility?

You don’t have to predict every market dip or headline to be a successful investor. What you do need is a plan for how to handle those ups and downs because they’re going to happen whether you like it or not. Let’s break down the strategies that actually help you stay steady when the market…

Continue ReadingToo Good to Be True? The Rise of Fake ‘Passive Income’ Investments

In today’s pursuit of financial security, the promise of passive income is enticing. However, this appeal has been exploited by scammers through various fraudulent schemes. Here’s an overview of some prevalent scams targeting those seeking reliable income: The Fake Dividend Trap The “Guaranteed Monthly Income” Scam Social Media & AI-Powered Investment Scams Protective Measures By…

Continue ReadingHow to Build a Dividend Portfolio: Basics & Considerations for Income Investing

Building a dividend portfolio is like planting a money tree that keeps giving. It’s not just about picking stocks that pay dividends; it’s about crafting a strategy that offers stability, passive income, and the magic of compounding growth. Let’s break down how to build a solid dividend portfolio, keeping it real and straightforward. Why Dividend…

Continue ReadingWhy the Dollar’s Value Matters (Even If You Think It Doesn’t)

You’ve heard it before – “The dollar is strengthening!” or “The dollar is falling!” It sounds like financial jargon, something that matters to traders and economists but not to everyday life. In reality, the dollar’s value impacts your wallet more than you might think. It influences prices at the grocery store, travel expenses, job security,…

Continue ReadingWhy the Price of Everything Feels Broken (and What You Can Actually Do)

Prices don’t always drop when costs fall – and sometimes they even rise when they seemingly don’t have to. This puzzling price stickiness isn’t just a quirk of the market; it’s a deliberate strategy that leaves consumers paying more without realizing it. In this article, we explore the tactics behind shrinkflation and ‘greedflation,’ unravel the…

Continue ReadingEconomic Deep Dive: Do the Jobs Numbers Even Mean Anything?

If you’ve ever read a news report saying “Unemployment is at a record low!” while also hearing about waves of layoffs, you might wonder: Which is true? The reality is that official job numbers don’t always reflect what’s happening in the real economy. A low unemployment rate doesn’t mean everyone is thriving, just like rising…

Continue ReadingManaging Debt: Strategies for Turbulent Times

Debt can be a powerful financial tool when managed well, but in times of economic uncertainty, it can also become a major source of stress. Whether it’s rising interest rates, job instability, or unexpected expenses, having a solid plan for managing debt is crucial to staying financially stable. By taking control of your debt now,…

Continue ReadingDon’t Get Duped: How to Recognize and Avoid Tax Scams

Tax season is here, and while most of us are busy gathering W-2s and crunching numbers, scammers are hard at work too. Every year, thousands of people fall victim to tax scams that drain bank accounts, steal identities, and create a whirlwind of stress. Let’s break down the most common tax scams, how they work,…

Continue ReadingReverse Mortgages: A Viable Option or a Risky Bet?

A reverse mortgage can seem like a lifeline offering access to much-needed cash during retirement. However, understanding the benefits, drawbacks, and potential pitfalls is crucial before deciding if this option aligns with your financial goals. The Basics: How Reverse Mortgages Work Reverse mortgages offer a way to convert home equity into cash without monthly mortgage…

Continue ReadingWho’s Actually Moving the Market?

If you’ve ever watched the market jump or crash and thought, “Who decided that?”, you’re not alone. It’s easy to assume it’s a crowd of everyday investors, each clicking “buy” or “sell” on their phones. But the truth is, retail traders (people trading their own money) make up a small slice of the action. Most…

Continue ReadingWhat on Earth is Market Volatility?

If you’ve ever checked your investment account and felt like you were on a rollercoaster, congratulations: you’ve experienced market volatility. But what does that even mean? In simple terms, volatility refers to how much and how quickly prices of stocks (or other investments) move up and down. A calm, steady market has low volatility. A…

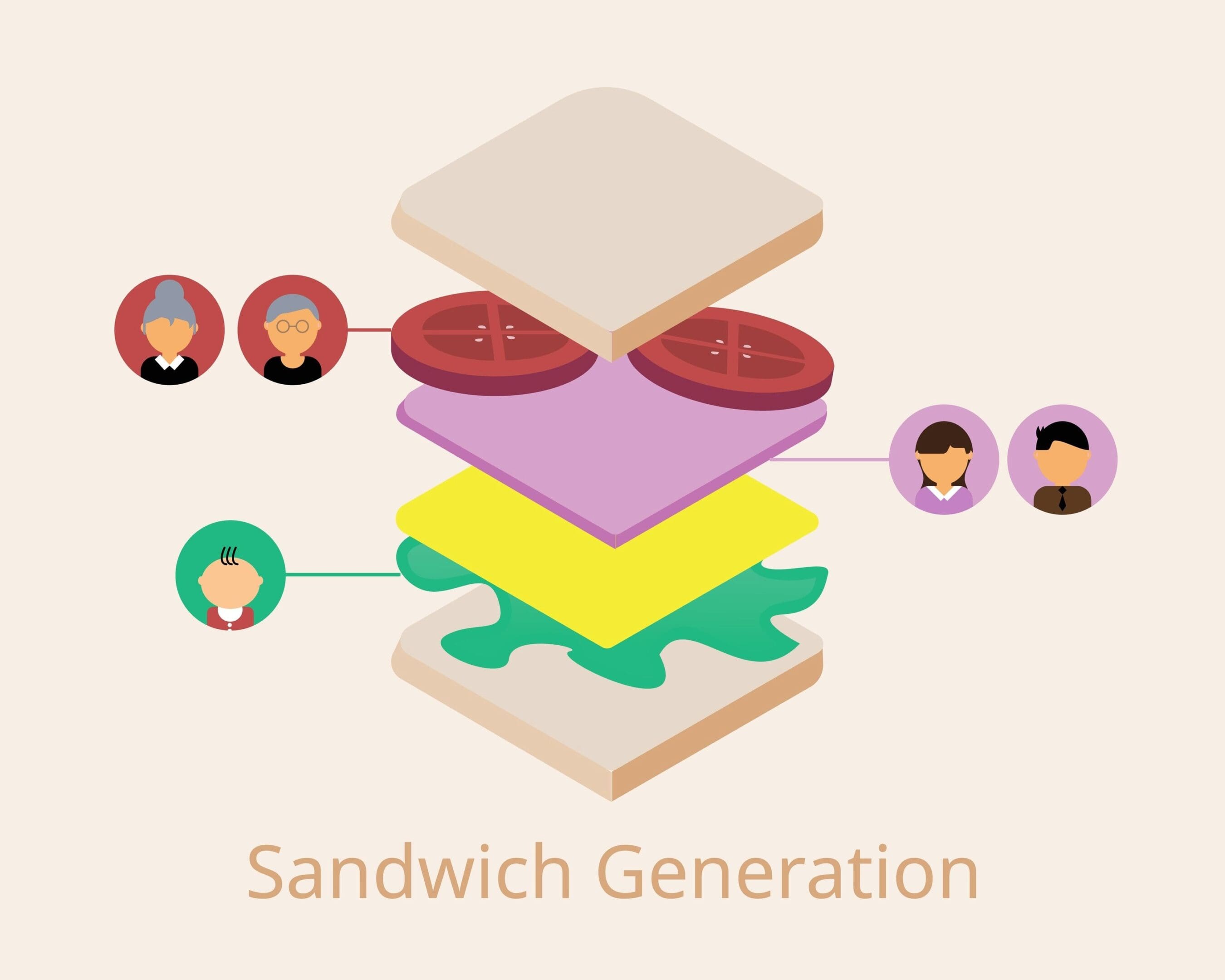

Continue ReadingNavigating the Financial Squeeze: The Realities of the Sandwich Generation

“Sometimes, carrying on, just carrying on, is the superhuman achievement.” – Albert Camus Life has a way of throwing curveballs just as you start feeling like you have things under control – building your career, saving for retirement, having a family and so on – but at some point, you suddenly find yourself responsible for…

Continue ReadingInflation-Protected Securities: Should You Consider TIPS?

Inflation eats away at your money, whether you notice it or not. One year, your grocery bill is manageable; the next, you’re wondering if you accidentally bought caviar. Enter TIPS (Treasury Inflation-Protected Securities) – bonds designed to keep up with rising prices. Sounds great, right? Well, not so fast. Let’s break down what they are,…

Continue ReadingUnderstanding Yield Curves: What They Signal for Your Portfolio

Let’s talk about the yield curve – no, we’re not talking about traffic signs. But just like a real yield sign tells you to slow down and pay attention, the yield curve can signal when the economy might be heading for a rough patch Yield curves are one of the most reliable economic indicators, often…

Continue ReadingEconomics 101: What Actually Matters for Your Wallet

When you hear terms like inflation, recession, or GDP, it can feel overwhelming. But these indicators aren’t just abstract numbers; they shape the cost of living, wage growth, and even the interest you pay on loans. Here’s a closer look at these key economic concepts: Inflation: Beyond the CPI Inflation measures the rate at which…

Continue ReadingHow Do My Skills Transfer? Making a Career Shift After a Layoff

Losing a job can feel like the rug has been pulled out from under you. Even more frustrating is hearing that companies are desperate for workers while you’re struggling to get interviews. If the job market is so strong, why is it so hard to find a new role? The answer isn’t always about your…

Continue ReadingBuilding an Emergency Fund: Your Financial Safety Net

Life is unpredictable. A sudden job loss, medical emergency, or unexpected home repair can throw even the best financial plans off track. That’s why having an emergency fund isn’t just a good idea – it’s essential. An emergency fund provides a financial cushion that helps you cover unexpected expenses without relying on debt or disrupting…

Continue ReadingThe Power of Expense Tracking: Navigating Financial Uncertainty

Financial uncertainty is a fact of life. Whether it’s rising costs, job instability, or unexpected expenses, economic shifts can happen anytime. The good news? You have more control than you think. One of the simplest yet most powerful ways to gain financial clarity is by tracking your expenses. At first, tracking expenses might seem tedious…

Continue ReadingMaking Sense of Your Tax World: A Guide for Every Stage

Get Our Complete Tax Season Playbook: Ready to master your tax planning? Subscribe now to access our comprehensive 12-chapter Tax Season Playbook, your complete guide to making tax-smart financial decisions: https://myretirementnetwork.com/subscribe Once you receive your welcome email from [email protected] simply reply with ‘Send Tax Guide” and we’ll make sure to reply with your private link…

Continue ReadingThe Study of JOY, Part 2

Last week we discussed the basis for finding happiness in our relationships and what that means in retirement. When you consider the relationships we have during our working lives and how structured they are, retirement is a huge change. Suddenly, we are without our colleagues on a daily basis, interacting with people a lot less.…

Continue ReadingTSP Death Benefits – PLEASE Check Your Beneficiaries

No one wants to think about planning for death – but sadly this is a reality that we must face and the better organized we are for those we leave behind, the better off they will be. No one wants to leave their spouse, kids, or any beneficiary with a mess. So today let’s start…

Continue ReadingThe TSP Mutual Fund Window

The Thrift Savings Plan (TSP) introduced additional investment options back in June of 2022 that left many with mixed feelings. This feature, allowing folks to choose from thousands of mutual funds, comes with its own set of challenges. Participants face contribution limits, additional fees, a vast array of options, and minimal guidance – essentially presenting…

Continue ReadingThe Study Of JOY

In 1938 scientists began a study to track the health of its participants over a long period of time to try to figure out what makes people healthy and happy. The study continues to this day, of course adding new participants (including the offspring of the OGs!). So what does this Harvard Study of Adult…

Continue ReadingJUNK Fees

The Consumer Financial Protection Bureau is taking companies to task to make sure you aren’t getting taken to the cleaners. Their plan is to save you billion$. To start, note that there is nothing wrong or illegal about adding fees to a service – the issue is that they are not being properly disclosed. Since they are…

Continue ReadingCoordinating FEHB and Medicare: What Federal Employees Need to Know

Federal Employees Health Benefits (FEHB) is a comprehensive health insurance program for federal employees, retirees, and their families. As federal employees approach retirement age, they often face questions about how their FEHB coverage will interact with Medicare. This coordination can be complex and often leads to confusion. While this won’t be our last discussion on…

Continue Reading- « Previous

- 1

- …

- 3

- 4

- 5