Your guide for retirement news, insights, and resources

Featured In:

AARP, Bankrate, Bloomberg, CBS News, CNBC, ETF.com, Financial Planning, Fortune, Fox Business, Investor’s Business Daily, Investopedia, Kiplinger, MarketWatch, MSN Money, Reuters, TheStreet, ThinkAdvisor, U.S. News & World Report, and The Wall Street Journal

How to Use AI Well in Your Financial Life

AI isn’t magic. It’s a tool. A fast one, a powerful one, but still just a tool. If you treat it like an advisor, it’s going to disappoint you. But if you use it to sharpen your thinking, it can save you time and help you see patterns you might have missed. You just have…

Continue ReadingWhy We Shut Down: When Money Stress Makes You Freeze

We often hear that financial problems should be solved with discipline. Just make a plan. Just take action. Just do something. But that’s not how people work when they are overwhelmed. When money is tight and pressure is high, the instinct is not always movement. Sometimes it’s paralysis. Bills pile up, decisions feel heavier, and…

Continue ReadingThe Fake Bank Trap: When High-Yield Accounts Aren’t Real

High-yield savings accounts are great if you’re trying to build an emergency fund or keep savings separate from checking. They allow you to earn at least some growth while keeping that money accessible in a pinch. But as more people look to stash their money in online banks, scammers are moving fast to meet them…

Continue ReadingThe Payday Loan Trap: When a Lifeline Turns Into a Loop

Imagine you’re short $300 to cover rent, your next paycheck is five days away, and your bank balance is nearly zero. For millions of Americans, this isn’t a hypothetical. It’s a monthly occurrence. Enter the payday loan. On the surface, payday loans offer fast cash with no credit check and minimal paperwork – often approved…

Continue ReadingTariffs: Who Pays, Who Gains?

It’s one thing to understand what a tariff is but it’s another to understand who benefits once it’s in place. If we pay more at the register, where does that money go? Is it fueling government programs? Offsetting deficits? Just disappearing into the system? And if higher prices are the price of “protectionism,” is anyone…

Continue ReadingWhy Expense Forecasting Is the Habit You Didn’t Know You Needed

Many people are familiar with expense tracking. You look back at what you’ve spent, categorize it, and highlight areas that could be more efficient based on your goals. It’s incredibly useful and something we strongly encourage. But it’s just one piece of the puzzle. There’s a reason every business doesn’t just track expenses but also…

Continue ReadingBudgeting App Scams Why “Safe Enough” Isn’t Good Enough

Last summer, Creditnews Research released its findings on the data safety practices of popular financial apps. Their findings were eye-opening. Not only did the majority of apps share some form of user information with third parties, but many shared far more sensitive data than users would expect. This issue doesn’t just affect budgeting tools—it stretches…

Continue ReadingThe Evolution of ‘Buy Now, Pay Later’ (BNPL) Services

A few decades ago, if you couldn’t afford to buy something outright, you had two options: wait and save, or use layaway. Layaway was a patience-based system – you paid for the item in installments before receiving it. It taught discipline, but it also came with the risk of cancellation, restocking fees, or simply losing…

Continue ReadingDay Trading Gurus: The Social Media Scam That Won’t Die

Social media has become the perfect stage for day trading scammers. They promise instant wealth, total freedom, and a life you can only get by joining their Discord group, paying for their signals, or copying their trades. TikTok and YouTube are packed with these stories. Some are polished. Some even look scrappy on purpose because…

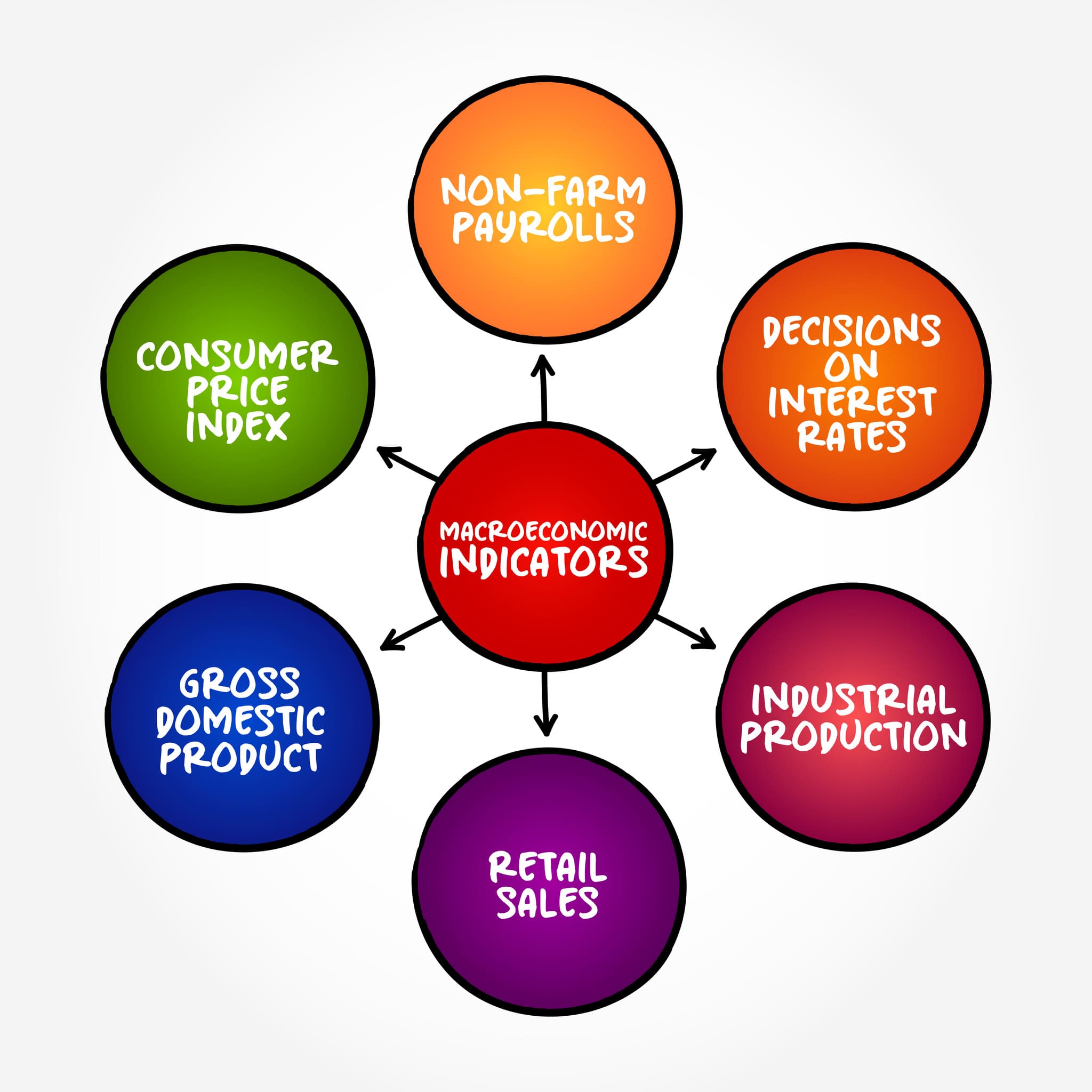

Continue ReadingWhy Does News Cause Market Swings?

Ever wonder why a company reports record profits and the stock drops? Or why bad economic news sometimes sends the market up? News affects markets – but not always in the way you’d expect. The Power of Earnings, Fed Announcements, and Data Drops Some news matters more than others. Corporate earnings reports give investors a…

Continue ReadingWhat on Earth is Market Volatility?

If you’ve ever checked your investment account and felt like you were on a rollercoaster, congratulations: you’ve experienced market volatility. But what does that even mean? In simple terms, volatility refers to how much and how quickly prices of stocks (or other investments) move up and down. A calm, steady market has low volatility. A…

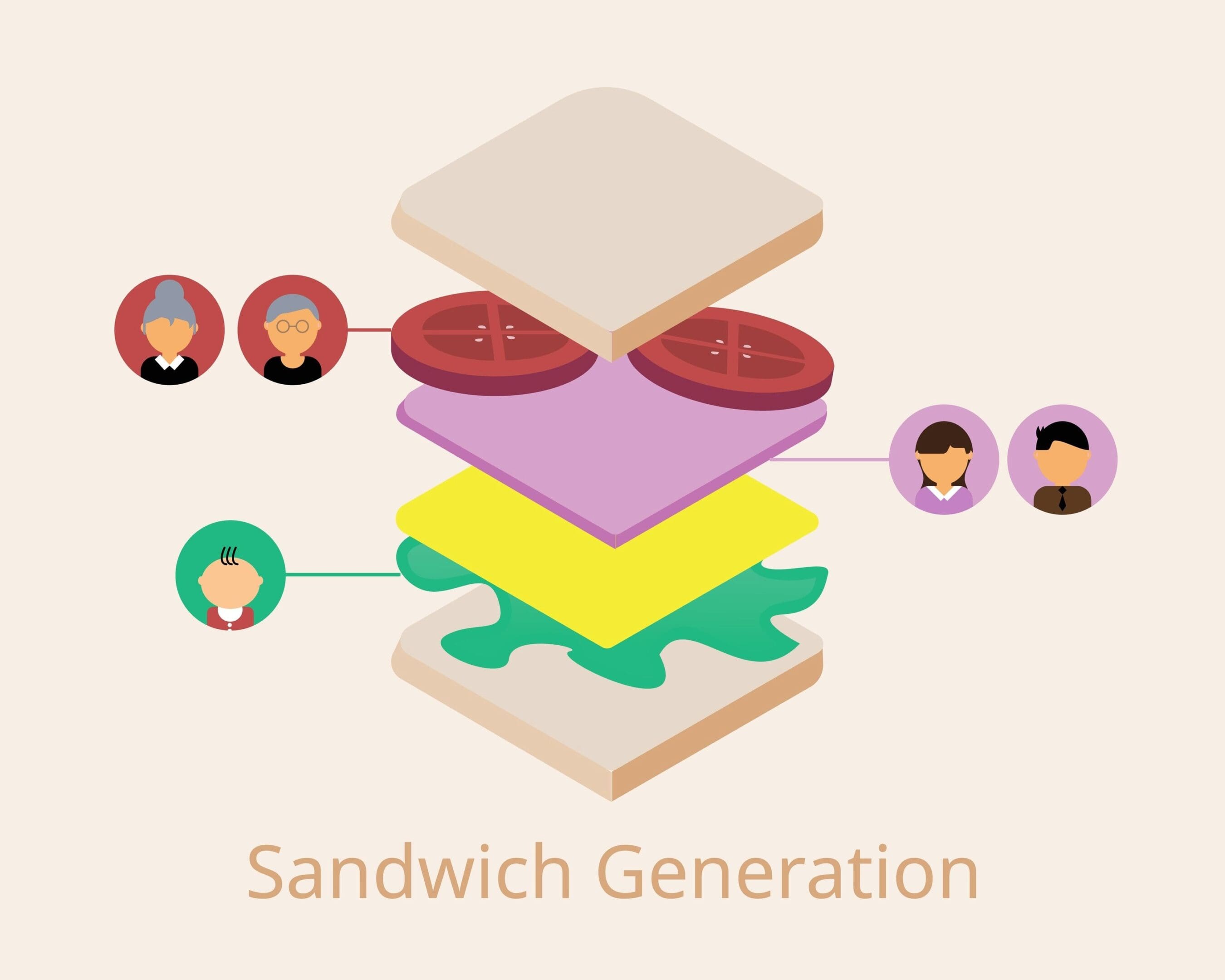

Continue ReadingNavigating the Financial Squeeze: The Realities of the Sandwich Generation

“Sometimes, carrying on, just carrying on, is the superhuman achievement.” – Albert Camus Life has a way of throwing curveballs just as you start feeling like you have things under control – building your career, saving for retirement, having a family and so on – but at some point, you suddenly find yourself responsible for…

Continue ReadingInflation-Protected Securities: Should You Consider TIPS?

Inflation eats away at your money, whether you notice it or not. One year, your grocery bill is manageable; the next, you’re wondering if you accidentally bought caviar. Enter TIPS (Treasury Inflation-Protected Securities) – bonds designed to keep up with rising prices. Sounds great, right? Well, not so fast. Let’s break down what they are,…

Continue ReadingUnderstanding Yield Curves: What They Signal for Your Portfolio

Let’s talk about the yield curve – no, we’re not talking about traffic signs. But just like a real yield sign tells you to slow down and pay attention, the yield curve can signal when the economy might be heading for a rough patch Yield curves are one of the most reliable economic indicators, often…

Continue ReadingEconomics 101: What Actually Matters for Your Wallet

When you hear terms like inflation, recession, or GDP, it can feel overwhelming. But these indicators aren’t just abstract numbers; they shape the cost of living, wage growth, and even the interest you pay on loans. Here’s a closer look at these key economic concepts: Inflation: Beyond the CPI Inflation measures the rate at which…

Continue ReadingHow Do My Skills Transfer? Making a Career Shift After a Layoff

Losing a job can feel like the rug has been pulled out from under you. Even more frustrating is hearing that companies are desperate for workers while you’re struggling to get interviews. If the job market is so strong, why is it so hard to find a new role? The answer isn’t always about your…

Continue ReadingBuilding an Emergency Fund: Your Financial Safety Net

Life is unpredictable. A sudden job loss, medical emergency, or unexpected home repair can throw even the best financial plans off track. That’s why having an emergency fund isn’t just a good idea – it’s essential. An emergency fund provides a financial cushion that helps you cover unexpected expenses without relying on debt or disrupting…

Continue ReadingThe Power of Expense Tracking: Navigating Financial Uncertainty

Financial uncertainty is a fact of life. Whether it’s rising costs, job instability, or unexpected expenses, economic shifts can happen anytime. The good news? You have more control than you think. One of the simplest yet most powerful ways to gain financial clarity is by tracking your expenses. At first, tracking expenses might seem tedious…

Continue ReadingMaking Sense of Your Tax World: A Guide for Every Stage

Get Our Complete Tax Season Playbook: Ready to master your tax planning? Subscribe now to access our comprehensive 12-chapter Tax Season Playbook, your complete guide to making tax-smart financial decisions: https://myretirementnetwork.com/subscribe Once you receive your welcome email from news@myretirementnetwork.com simply reply with ‘Send Tax Guide” and we’ll make sure to reply with your private link…

Continue ReadingThe Ownership Illusion: Is Homeownership Still the American Dream?

Owning a home has long been a cornerstone of the American Dream, and recent surveys show that sentiment hasn’t changed. According to Realtor.com and Bankrate, homeownership remains a top priority for many Americans. Even those who anticipate challenges in achieving it still view owning a home as a key marker of success and an essential…

Continue ReadingWhy Financial Conversations Leave So Many People Feeling Foggy

You show up prepared. Maybe you’ve got a few questions written down, maybe you’ve reviewed your account statements, maybe you’ve even watched a few videos to brush up on the basics. You’re trying to be proactive. But somewhere during the conversation, things start to slip. You hear a stream of words that sound technical and…

Continue ReadingThe 4 Most Misunderstood Words in Financial Conversations

If you’ve ever walked away from a financial conversation feeling like you “should” have understood more, you’re not alone. A big part of the confusion comes down to language. Financial professionals often use everyday words that sound familiar but carry a different meaning once they’re inside a retirement plan, an insurance policy, or an investment…

Continue ReadingFake AI “Advisors” Offering Personalized Plans

AI-based tools are all over the financial space right now. Some are legitimate. Some just want your data. And in between, there’s a growing category of suspicious sites pretending to offer personalized financial advice powered by artificial intelligence. This isn’t a new scam. It’s just a rebranded version of the old “free retirement plan” pitch,…

Continue ReadingThe Real Risk Isn’t AI. It’s the Urge to Hand Over the Wheel

We all say we want financial clarity. But sometimes, what we actually want is someone (or something) to just tell us what to do. That’s where AI starts to feel seductive. It’s fast. It’s confident. It doesn’t get tired or judge you. It doesn’t even need context – it just needs inputs. But that’s also…

Continue ReadingYou Don’t Need Investing Advice If You’re Not Investing

We live in an age of nonstop financial noise. We hear about asset allocation, sequence of returns risk, and rebalancing… but what if you don’t even have a portfolio or a company plan to contribute to? That is a very real situation for millions of people. If you’re focused on paying the bills, managing debt,…

Continue ReadingWhy Debt Creates Shame (And Why That Shame Isn’t Yours to Carry)

Debt is a financial issue, but it rarely feels like just a math problem. It feels like a moral one. Like failure. Like everyone else has it together and you missed something obvious. And unlike other financial challenges, debt tends to carry a weight that goes beyond the balance. It carries shame. Quiet, isolating shame…

Continue ReadingThe Tariff Excuse

Any time prices start rising, explanations follow. Some are legitimate. Others? Not so much. And lately, one excuse has been popping up more and more: “Because of tariffs.” Retailers and manufacturers know that most consumers don’t fully understand how tariffs work—or whether they even apply to the products they’re buying. That gap in knowledge creates…

Continue ReadingThe Dopamine of RETAIL THERAPY

You clicked “Pay Later.” It felt like control. Easy. Harmless. Almost smart. But that little rush you got when you hit the buy button? That wasn’t budgeting. That was dopamine. Retail therapy isn’t just a joke or a meme. It is a real psychological loop. When we shop, especially when we are stressed, bored, or…

Continue ReadingWhen Do Financial Professionals Actually Take Action During Market Drops?

Now that we’ve clarified when “stay the course” applies and why it’s used, let’s look at the other side of the coin: when to take action. Even in the best of times, financial plans evolve. A solid plan needs to be flexible and sometimes that means making changes. Financial professionals don’t sit idle through every…

Continue ReadingFear-Based Scams: How Market Panics Create Easy Targets

When markets get shaky, emotions run high – and scammers know it. Fear, confusion, and a sense of urgency are exactly the conditions fraudsters look for. During volatile markets, scam activity often surges because people are more vulnerable. They’re scared about losing money and looking for quick solutions or safer alternatives. That’s when the predators…

Continue Reading