How Can You Prepare for Volatility?

You don’t have to predict every market dip or headline to be a successful investor. What you do need is a plan for how to handle those ups and downs because they’re going to happen whether you like it or not. Let’s break down the strategies that actually help you stay steady when the market…

Read MoreWhat on Earth is Market Volatility?

If you’ve ever checked your investment account and felt like you were on a rollercoaster, congratulations: you’ve experienced market volatility. But what does that even mean? In simple terms, volatility refers to how much and how quickly prices of stocks (or other investments) move up and down. A calm, steady market has low volatility. A…

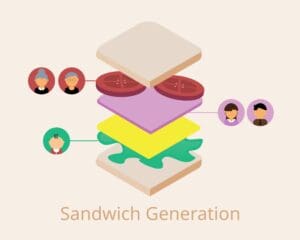

Read MoreNavigating the Financial Squeeze: The Realities of the Sandwich Generation

“Sometimes, carrying on, just carrying on, is the superhuman achievement.” – Albert Camus Life has a way of throwing curveballs just as you start feeling like you have things under control – building your career, saving for retirement, having a family and so on – but at some point, you suddenly find yourself responsible for…

Read MoreInflation-Protected Securities: Should You Consider TIPS?

Inflation eats away at your money, whether you notice it or not. One year, your grocery bill is manageable; the next, you’re wondering if you accidentally bought caviar. Enter TIPS (Treasury Inflation-Protected Securities) – bonds designed to keep up with rising prices. Sounds great, right? Well, not so fast. Let’s break down what they are,…

Read MoreHow to Build a Dividend Portfolio: Basics & Considerations for Income Investing

Building a dividend portfolio is like planting a money tree that keeps giving. It’s not just about picking stocks that pay dividends; it’s about crafting a strategy that offers stability, passive income, and the magic of compounding growth. Let’s break down how to build a solid dividend portfolio, keeping it real and straightforward. Why Dividend…

Read MoreWhy the Dollar’s Value Matters (Even If You Think It Doesn’t)

You’ve heard it before – “The dollar is strengthening!” or “The dollar is falling!” It sounds like financial jargon, something that matters to traders and economists but not to everyday life. In reality, the dollar’s value impacts your wallet more than you might think. It influences prices at the grocery store, travel expenses, job security,…

Read MoreUnderstanding Yield Curves: What They Signal for Your Portfolio

Let’s talk about the yield curve – no, we’re not talking about traffic signs. But just like a real yield sign tells you to slow down and pay attention, the yield curve can signal when the economy might be heading for a rough patch Yield curves are one of the most reliable economic indicators, often…

Read MoreWhy the Price of Everything Feels Broken (and What You Can Actually Do)

Prices don’t always drop when costs fall – and sometimes they even rise when they seemingly don’t have to. This puzzling price stickiness isn’t just a quirk of the market; it’s a deliberate strategy that leaves consumers paying more without realizing it. In this article, we explore the tactics behind shrinkflation and ‘greedflation,’ unravel the…

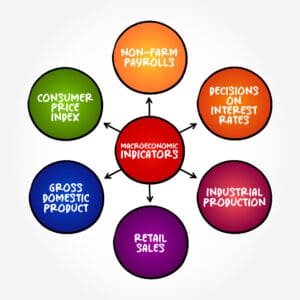

Read MoreEconomics 101: What Actually Matters for Your Wallet

When you hear terms like inflation, recession, or GDP, it can feel overwhelming. But these indicators aren’t just abstract numbers; they shape the cost of living, wage growth, and even the interest you pay on loans. Here’s a closer look at these key economic concepts: Inflation: Beyond the CPI Inflation measures the rate at which…

Read MoreEconomic Deep Dive: Do the Jobs Numbers Even Mean Anything?

If you’ve ever read a news report saying “Unemployment is at a record low!” while also hearing about waves of layoffs, you might wonder: Which is true? The reality is that official job numbers don’t always reflect what’s happening in the real economy. A low unemployment rate doesn’t mean everyone is thriving, just like rising…

Read More