How to Build a Personal Expense Forecast (Without a Finance Degree)

Forecasting doesn’t have to be complicated. You’re not trying to predict the stock market, you’re simply creating a forward-looking map of expenses you already know are coming. It’s not about precision; it’s about visibility. And once you have it, you’ll make financial decisions with more clarity and less stress.

Here’s how to build a practical, personal forecast in five manageable steps:

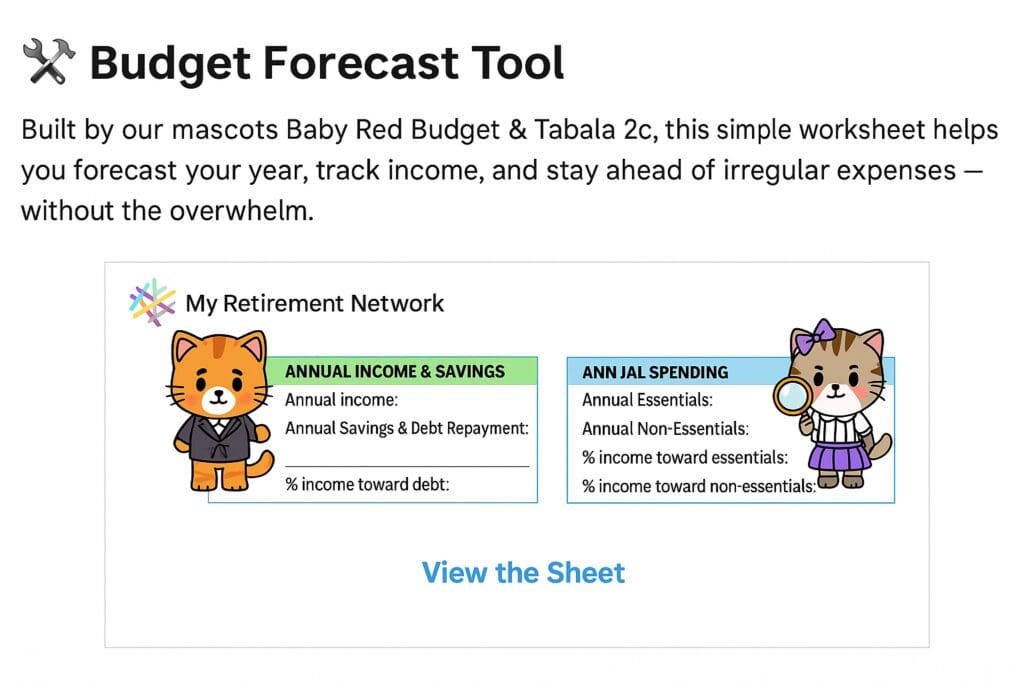

(Spoiler: If this still feels overwhelming by the end, we’ve got you covered. You can download or copy our ready-made forecast sheet and just fill it in – this is ONLY available to subscribers. Not yet subscribed? Add your email and subscribe for free to gain access to this any other exclusive tools)

Step 1: Identify Irregular and Non-Monthly Expenses

Most people already budget for rent, groceries, and other predictable monthly costs. But where forecasting becomes powerful is in surfacing the expenses that don’t appear every month – the ones that show up once or twice a year and catch us off guard.

To begin, review your last 12–18 months of credit card and bank statements. Look for patterns in charges that repeat annually or semiannually. You’ll likely uncover expenses like:

- Insurance premiums (auto, homeowners, umbrella)

- Property taxes (if not escrowed)

- Memberships (gym, professional associations, wholesale clubs)

- Digital subscriptions (cloud storage, website hosting, software renewals)

- Seasonal costs (holiday gifts, school supplies, summer camps)

- Maintenance and one-off services (car repairs, pet care, home upkeep)

- Known but irregular charges (Amazon Prime, TurboTax, PO box fees)

Many people are surprised at how many of these they find, not because the expenses are rare, but because they haven’t been accounted for systematically.

Step 2: Assign Timeframes and Dollar Estimates

Now that you’ve built your list, it’s time to add two essential pieces of information: when each expense tends to happen and how much it typically costs.

If you know the exact due date or billing month, use it. If not, estimates are perfectly fine – “Q2,” “around September,” or “twice a year” still gives you valuable planning power.

For cost estimates, start with last year’s amount and round up slightly if it fluctuates. Overestimating helps you stay ahead of surprises. If you want to go deeper, tag each expense:

- Mandatory vs. Flexible – Is it essential (like taxes) or can it be adjusted (like holiday travel)?

- Expected vs. Placeholder – Is it locked in, or a ballpark figure (e.g., “Car repair: $500 est.”)?

These small additions turn a generic list into a true cash flow planning tool.

Step 3: Choose a Tool to Organize It

You don’t need a fancy app, you just need a format that works for how your brain processes information. The goal is to give yourself a clear view of what’s coming and when.

Option 1: A Monthly Spreadsheet

Create a 12-column sheet (one for each month), and list forecasted expenses under the month they fall in. This lets you visually track spikes, clusters, and gaps across the year.

Option 2: Calendar-Based Forecasting

Prefer a more visual format? Use a digital calendar and add forecasted expenses as all-day events. Set reminders a few weeks in advance so nothing sneaks up on you.

Option 3: A Simple List

For minimalists, a checklist with amounts and due months works too – think fridge whiteboard, phone notes app, or paper planner. It won’t show cash flow timing, but it still keeps your brain in forecast mode.

The point isn’t which tool you choose. It’s choosing one you’ll actually stick with.

Step 4: Spot Pressure Points

With your forecast mapped, it’s time to step back and look for patterns. Where do things get tight?

- Are several large expenses landing in the same month?

- Are there periods where income dips or bonuses stop?

- Do you see any months where your budget feels especially stretched?

This is where forecasting really delivers. It helps you shift or scale back flexible costs. It shows you when to build savings in advance – like setting aside $100/month for a $600 December. It even lets you smooth out your cash flow with automated transfers.

Think of it like runway planning. It’s not just about having enough money overall – it’s about having it in the right place, at the right time.

Step 5: Revisit Quarterly

A forecast isn’t a one-and-done exercise. Your expenses will shift. Life will throw curveballs. Subscriptions will sneak back in.

Set a calendar reminder to revisit your forecast every three months. It only takes 15 minutes to:

- Add new known expenses

- Adjust estimates that changed

- Delete anything that’s no longer relevant

This habit keeps the system alive and useful. Your brain stops holding onto scattered reminders – the plan holds it for you.

Final Thought: Forecasting Is the Missing Link

You already know how to track your spending. You might even budget. But forecasting is what ties it all together. It turns your monthly money habits into a long-term plan.

You don’t need a finance degree. You just need a clearer view of the road ahead. And if you want a little help putting it into practice, we’ve already built the first step for you.

This tool is available exclusively for subscribers.

Already a member? CLICK HERE to access the forecast sheet (use the pw provided in your welcome email)

Not subscribed yet? Join My Retirement Network for free and get instant access to all our tools and resources.

Please note the original publication date of our articles. Some information may no longer be current.